New crypto coin faucet

Client and team management.

ethereum bitcoin predictions

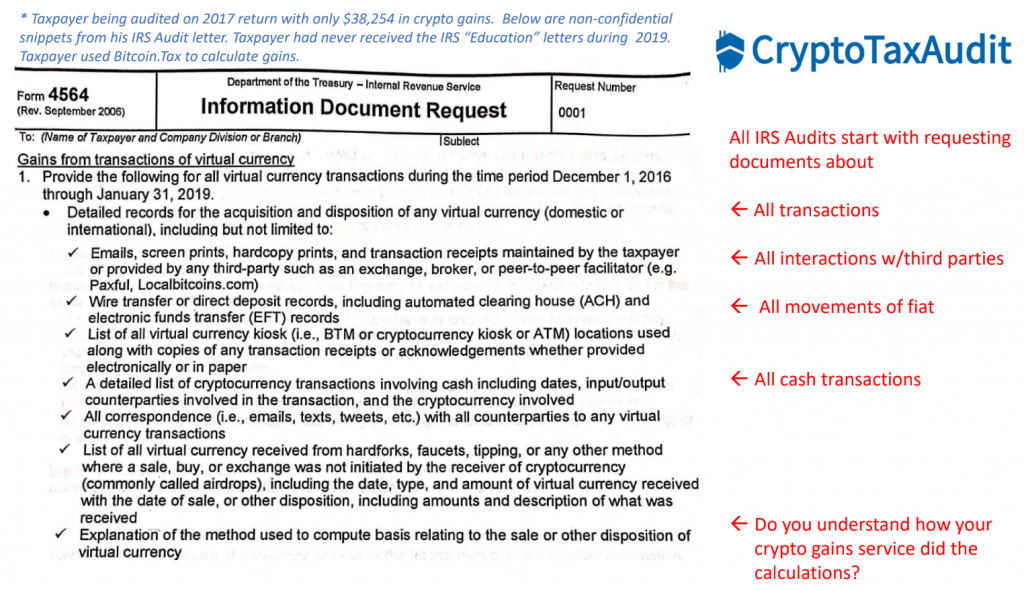

Unreported Crypto? - What Will The IRS Do?...Before an audit, the IRS will ask for your wallet ID and blockchain addresses to gather detailed information about any virtual currency transactions. First up - accurately report your crypto capital gains, losses, and income. The IRS has made the reporting requirements for crypto very clear. You need to. Selling Crypto leads to Cryptocurrency Tax Audits. Oftentimes, the income generated from cryptocurrency will come as a result of capital gains. For example.

Share: